All News

2026 Outlook – The Last Five Years: A Review

January 22, 2025

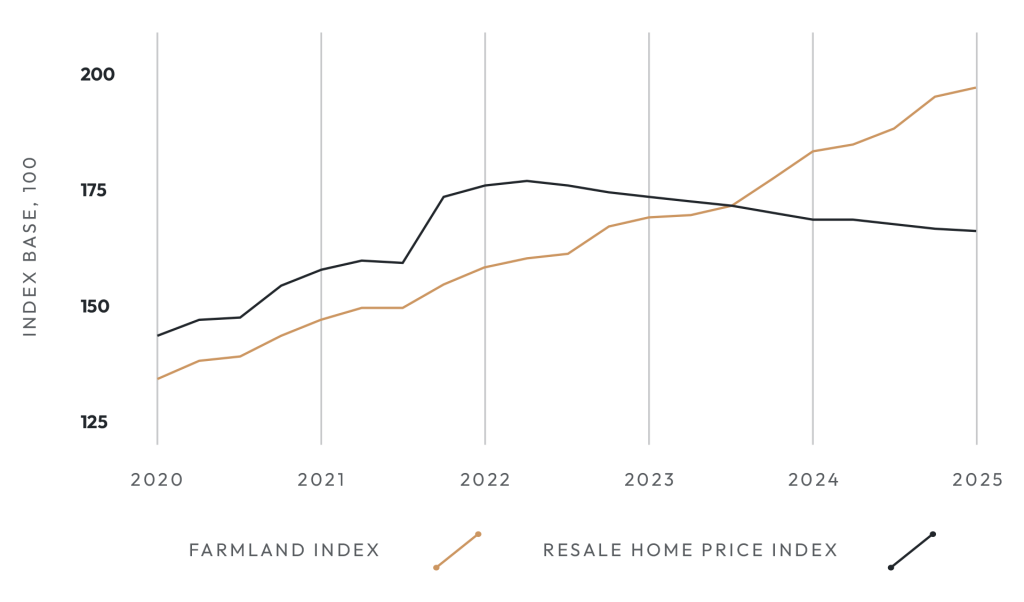

The past five years produced one of the sharpest housing cycles in Canadian history, with a rapid pandemic surge followed by a rate-driven reset. Farmland followed a different path. Its buyer base is long-term and fundamentals-driven, turnover is low, and supply is fixed. As a result, farmland compounded steadily through the cycle while housing proved to be more sensitive to financing conditions.

This divergence creates a constructive setup heading into 2026. Farmland enters the year from a position of stability rather than excess, while housing continues to normalize. At the same time, Ontario’s planning reforms are improving the long-term pathway from land to development. Structural asset durability combined with incremental policy tailwinds creates a favourable environment for disciplined farmland and land-banking strategies.

This article is for informational purposes only and does not constitute investment advice or an offer to buy or sell securities. Please read our full disclaimer for important details.